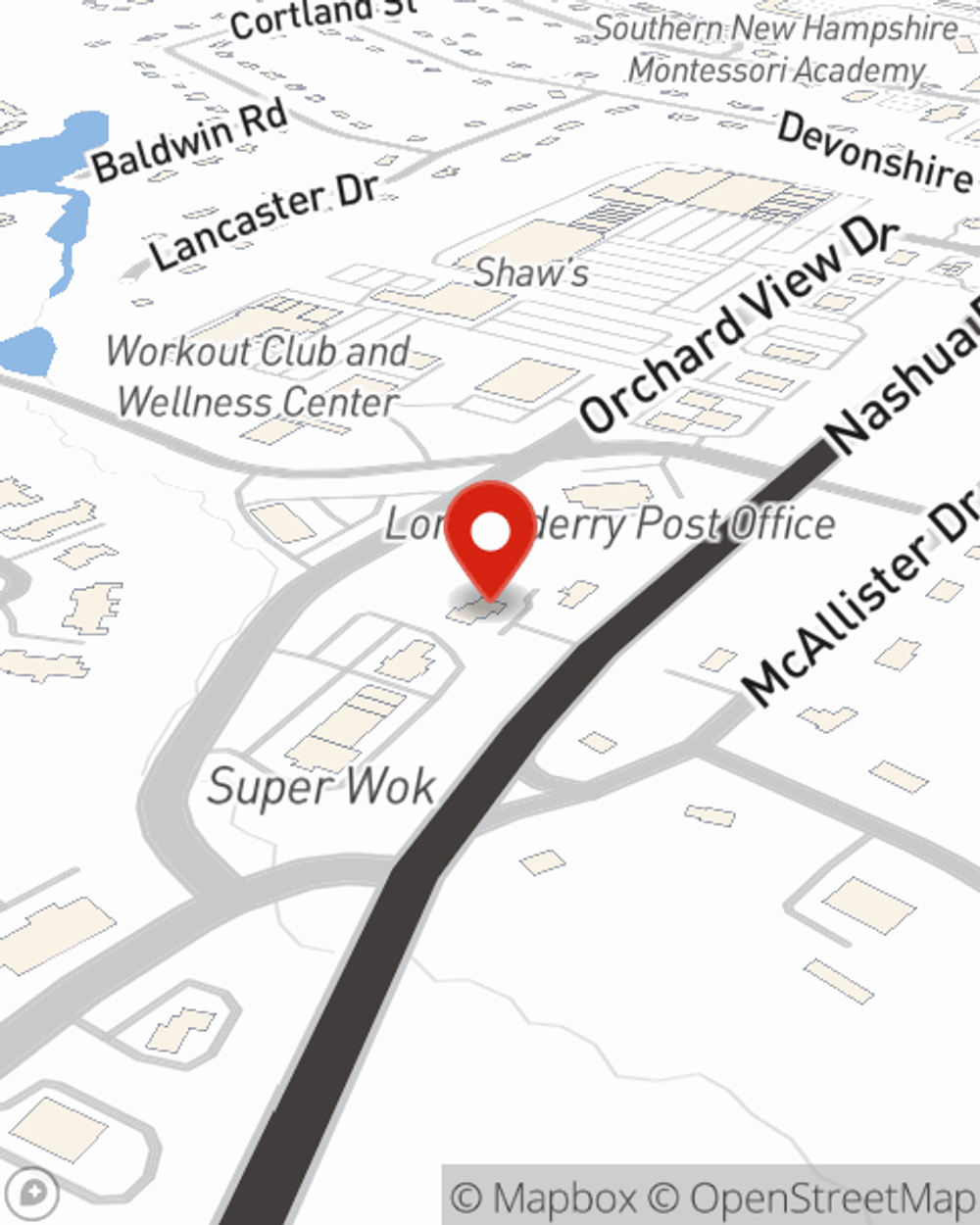

Business Insurance in and around Londonderry

Calling all small business owners of Londonderry!

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

Do you own a barber shop, cosmetic store or a hair salon? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on your next steps.

Calling all small business owners of Londonderry!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

Your business thrives off your determination commitment, and having outstanding coverage with State Farm. While you do what you love and support your customers, let State Farm do their part in supporting you with artisan and service contractors policies, commercial auto policies and business owners policies.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Jamie Reynolds's team to identify the options specifically available to you!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Jamie Reynolds

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.